Goldman Sachs pays a lot of people to keep messes out of the papers. This time, the mess had a name, a title, and a corner office.

What You Should Know

Kathryn Ruemmler is resigning as Goldman Sachs’ general counsel, effective June 30th, 2026, after DOJ-released Epstein files surfaced emails and calendar entries describing her relationship with Jeffrey Epstein. Goldman CEO David Solomon said he accepted her resignation.

Ruemmler is not just any in-house lawyer. She is the former White House counsel to President Barack Obama, a big-ticket hire who joined Goldman Sachs in 2020, and a top figure in the bank’s internal machine for weighing reputational land mines before they detonate.

The Bank’s Reputational Gatekeeper Gets Tagged

On January 11th, 2026, CBS News reported that Ruemmler told the network she was resigning as general counsel. Goldman Sachs CEO David Solomon confirmed it, saying he accepted her resignation and respected her decision. He praised her as an “extraordinary general counsel” who would be missed.

The irony is doing most of the talking. According to CBS News, Ruemmler also co-chairs Goldman Sachs’ reputational risk committee. That means the person tasked with spotting the kinds of relationships that can embarrass a global bank is now leaving amid public scrutiny over her own past relationship with Jeffrey Epstein.

Goldman did not describe any additional internal action in the CBS News report beyond acknowledging the resignation. The departure date, June 30th, 2026, gives the bank time to manage a transition. It also gives the story room to breathe.

The Emails Put Details Back on the Record

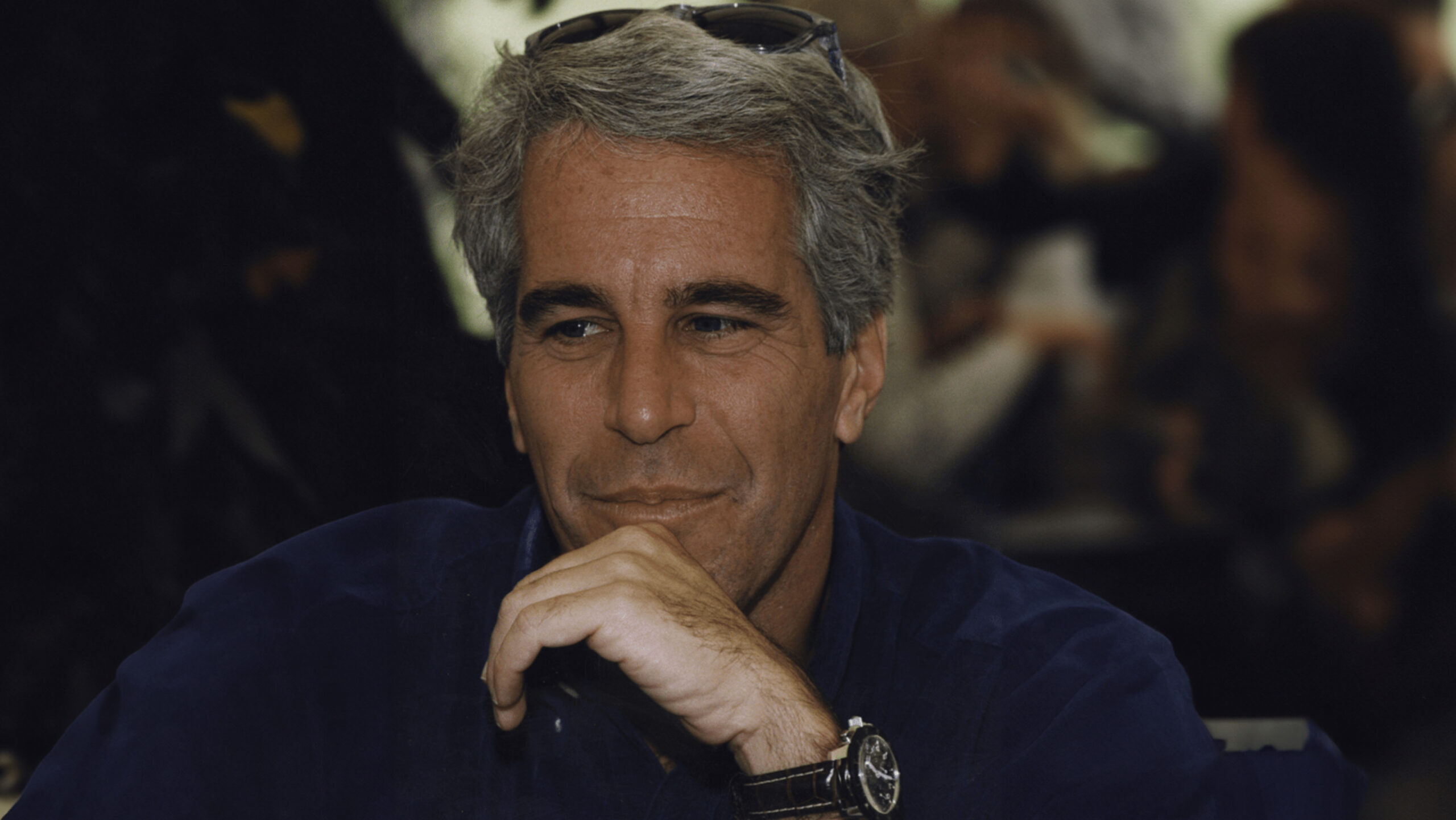

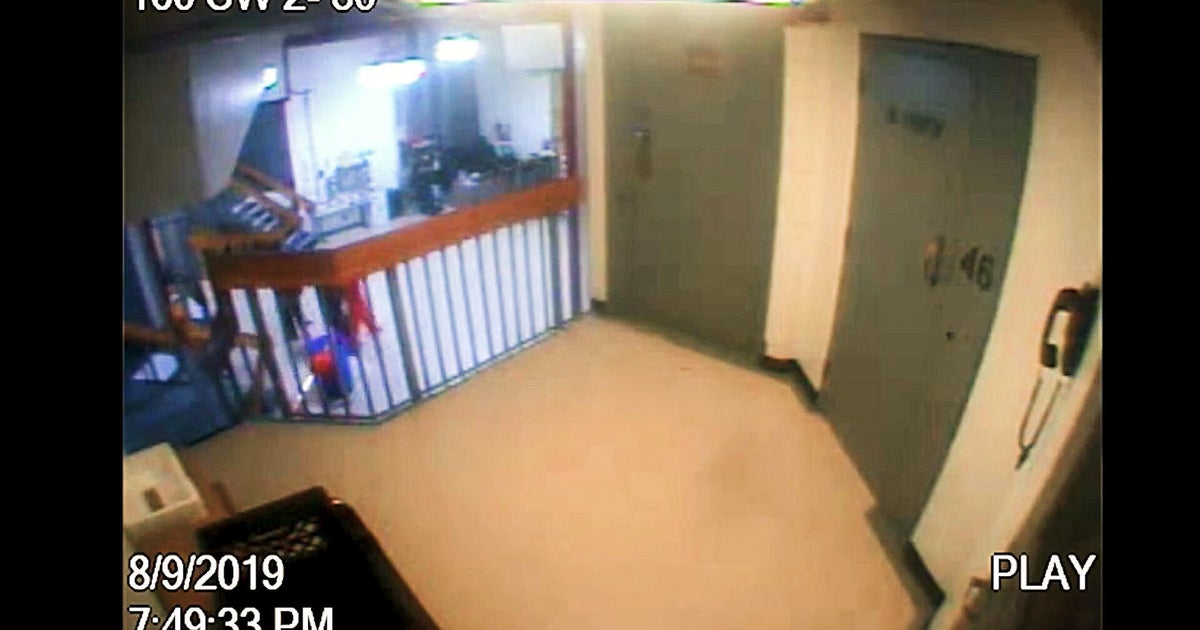

The immediate trigger was the release of additional DOJ material tied to Epstein, a convicted sex offender who moved for years through elite networks that mixed money, access, and discretion. According to CBS News, Ruemmler’s name appeared in multiple emails disclosed by the Justice Department, with messages spanning 2014 through 2019, the year Epstein died in federal custody.

One exchange, dated December 2015, is the kind of line that reads differently once the world knows what it knows. In an email to a redacted recipient, Ruemmler wrote, “I adore him. It’s like having another older brother.” CBS News reported that the comment came after Epstein offered to buy her a first-class ticket to Europe.

That is the tightrope for powerful institutions. What might have been described as networking, mentorship, or social noise in real time becomes a liability once the name attached is Epstein, and once the paper trail is public.

White House Access, Hollywood Requests, and the Currency of Favors

The messages cited by CBS News were not limited to pleasantries. They also included a request that sits at the intersection of celebrity, access, and politics.

In May 2015, Epstein asked Ruemmler if she could get filmmaker Woody Allen and his wife, Soon-Yi Previn, a tour of the White House, CBS News reported. Epstein wrote that he assumed Woody would be too politically sensitive. Ruemmler responded that she could get the tour, while also noting Epstein might be too politically sensitive.

According to CBS News, White House records show the tour happened in December 2015.

Even if the tour itself was routine, the power dynamic is not. A private citizen asks another private citizen, who once held a high government role, to arrange access to the White House for a famous couple. The request travels through personal relationships, not formal channels. That is the currency: introductions, doors opened, and the quiet confidence that somebody can make it happen.

When a bank’s top lawyer is connected to a figure like Epstein in that kind of context, it is not just a personal story. It becomes a governance story.

The Calendar Note That Reads Like a Tabloid, Not a Legal File

Then there is the calendar.

CBS News reported that Epstein’s calendar showed dozens of scheduled meetings and events involving Ruemmler. One entry, dated February 6th, 2018, included a line that sounds less like finance or law and more like celebrity backstage logistics: “Kathy Ruemmler to have the Glam Squad to her NY apt for 9am.”

It is unclear, CBS News noted, why Epstein was tracking what appeared to be a hair and makeup appointment.

That “why” is the gasoline. A reputational crisis does not require proven wrongdoing. It requires unanswered questions, a recognizable villain, and documentation that invites people to connect the dots. Calendars, emails, and guest logs do that work with brutal efficiency.

Regret, Then Resignation

One detail makes Ruemmler’s resignation harder to write off as a simple personnel change. According to CBS News, Ruemmler told The Wall Street Journal in 2023 that she regretted ever knowing Jeffrey Epstein.

That sets up the central contradiction now sitting on Goldman’s desk. The public expression of regret exists alongside older private messages that read warm, familiar, and close. Both can be true in the sense that people reassess relationships after new information. However, in a scandal economy, the timeline matters almost as much as the substance.

If you are Goldman Sachs, you do not just manage the facts. You manage the perception that your leadership team, especially the team responsible for legal exposure and reputation, is equipped to avoid exactly this kind of headline.

Why Goldman Cares More Than Most Companies

Big banks trade on trust while making money on risk. They also live under a microscope that most corporations never face. The general counsel is not simply a lawyer who signs off on contracts. The job is to anticipate what regulators, investors, and clients will say when a story turns.

Ruemmler’s resume was designed for that world: senior White House role, elite law firm experience, and then a jump to Goldman Sachs. CBS News reported she served as White House counsel from 2011 to 2014, joined Latham and Watkins in 2014, and then moved to Goldman in 2020.

That type of background can calm boards and reassure clients. It can also amplify the fallout when something looks off, because the expectation is that the person with that pedigree should understand the cost of proximity to risky people.

What Happens Next, and What to Watch

Goldman Sachs has time to choreograph the handoff. The effective date gives the firm a runway to name an interim or permanent replacement, redistribute responsibilities, and signal stability to markets and clients.

The bigger question is whether more material from the DOJ releases keeps landing, and whether any of it changes the contours of what is currently a reputational story rather than a legal accusation. CBS News framed the disclosed material as additional details on a relationship, not as evidence of criminal conduct by Ruemmler.

For observers of elite networks, it is also a reminder of how Epstein’s orbit worked. Access was offered like a perk, favors were requested like they were normal, and the documentation, once out in the open, forces institutions to explain who was in the room and why.

Ruemmler’s resignation is a personal career turn. For Goldman Sachs, it is a public stress test of how a brand sells risk management when the risk shows up in its own executive suite.