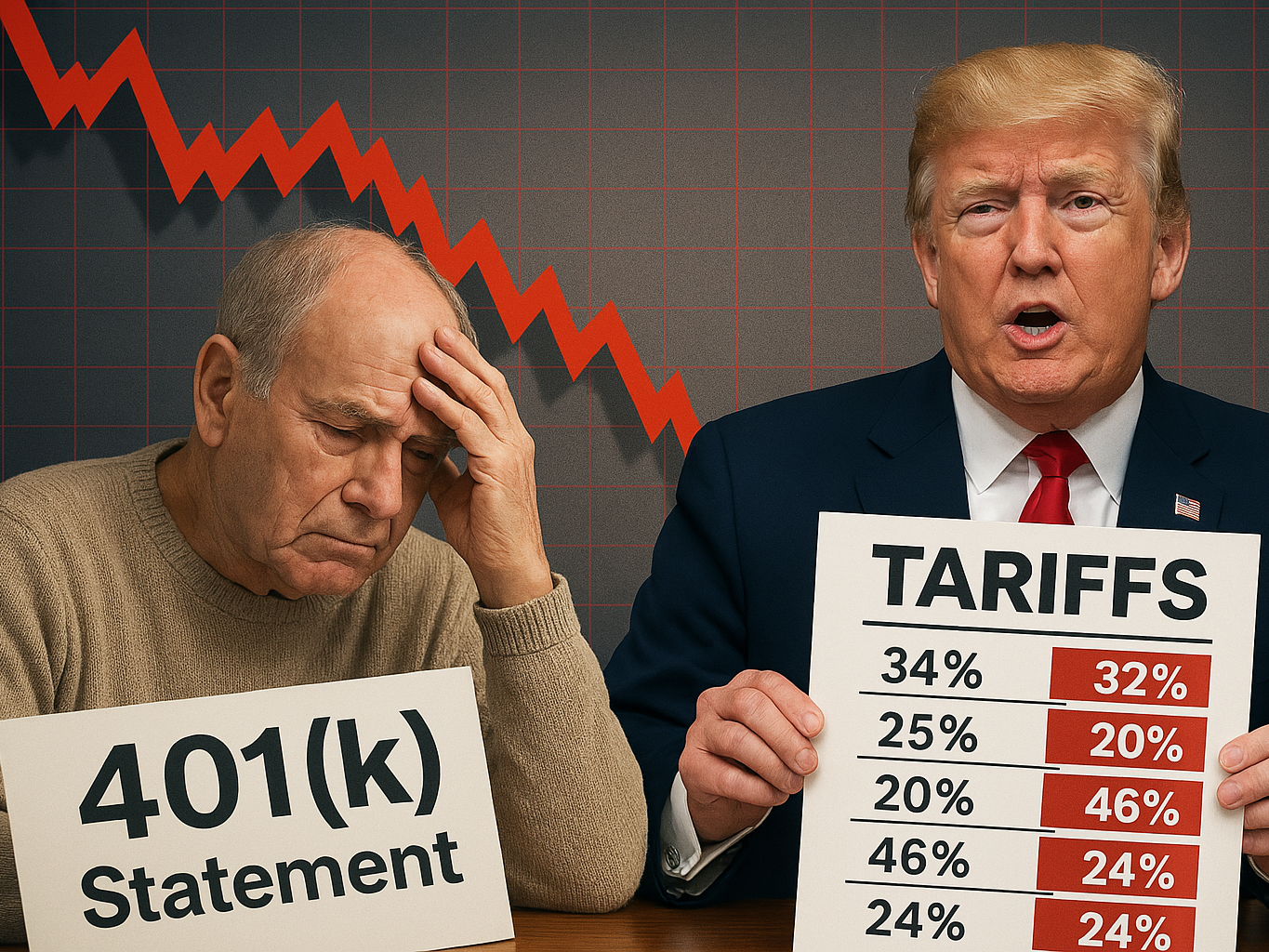

America’s trade war just went nuclear — and millions of retirees watched their 401(k)s implode in real time. After weeks of threats, President Donald Trump’s sweeping tariffs finally hit, sending U.S. stock markets into a nosedive and sparking fears of rising prices, global retaliation, and long-term economic instability. It’s not just Wall Street reeling — it’s Main Street, too.

Moments after Trump declared April 2 “Liberation Day,” futures tracking the S&P 500 fell 2 percent, the Nasdaq dropped more than 3%, and the Dow lost nearly 900 points in after-hours trading, as reported by The Daily Mail. Within minutes, trillions were wiped off the value of Americans’ 401(k) retirement accounts as the Nasdaq-100 tumbled 4.2% and major importer stocks.

What Did Trump Announce?

Standing in the White House Rose Garden, Trump unveiled a 10% across-the-board tariff on all foreign imports, effective April 5. But that was just the opening salvo. He then held up a large chart revealing sky-high rates for individual countries, including:

– 34% on Chinese goods

– 32% on Taiwan

– 25% on foreign-made vehicles

– 20% on the European Union

– 46% on Vietnam

– 24% on Japan

– 26% on India

Why This Matters: Who’s Paying the Price?

While Trump’s supporters view the tariffs as a bold move to bring manufacturing back to U.S. soil and end decades of trade imbalance, economists say American consumers and businesses will bear the brunt — especially those living on fixed incomes or relying on retirement savings.

In fact, the Federal Reserve Bank of Boston warned that these tariffs could raise core inflation by up to 2.2% points, driving up prices on everything from housing to hospital services.

More than 60% of imported vegetables come from Mexico, while 80% of U.S. toys are made in China. These items — along with clothing, cars, electronics, and medical supplies — are likely to become more expensive quickly.

What About Your Retirement?

If you own a 401(k), you’re probably already feeling the hit. Most American retirement plans are heavily invested in index funds that track the S&P 500, Nasdaq, and Dow — all of which plummeted after the announcement.

It’s not just short-term volatility. Experts say the uncertainty could stretch out over months, as global markets try to adjust to a new trade landscape. Some say market instability may linger with tariffs this high in place.

What’s the White House Saying?

Trump declared the tariffs as a “declaration of economic independence,” insisting that foreign countries have “pillaged” the U.S. for decades, as reported by The Daily Mail. He promised the levies would raise hundreds of billions in new revenue and bring factory jobs back home.

White House economists argue that the burden of tariffs will fall on foreign exporters, not Americans. Stephen Miran, chair of the Council of Economic Advisers, said, “as the world’s largest source of consumer demand, the U.S. holds all the leverage, which means foreign suppliers will have to eat the economic burden or ‘incidence’ of the tariffs,” as reported by CNBC.

But that claim is disputed by independent researchers, who say history shows U.S. consumers always end up footing part of the bill, either through higher prices or shrinking product choices.

Is This a Repeat of History?

Tariffs aren’t new. But economists warn that this fast-paced, unpredictable approach — where tariffs are imposed, changed, or revoked with little notice — creates instability for businesses and households alike.

In 2018, Trump’s first trade war resulted in modest gains for steelworkers — but broader manufacturing jobs declined because industries reliant on steel and aluminum were hit harder by rising input costs.

The difference now is scale. Wednesday’s announcement would push U.S. tariffs to the highest level since the early 20th century, according to KPMG chief economist Diane Swonk, as reported by Market Watch.

What Happens Next?

Markets remain volatile, and many key details are still unclear — including how long the tariffs will remain in place and whether the administration is open to negotiation.

Global allies, like the European Union and Japan, have so far withheld retaliatory measures. But tensions are rising. Analysts expect counter-tariffs or legal action at the World Trade Organization if the U.S. continues down this path.

For now, Americans are left to wait — and watch their portfolios.

References: Trump’s tariffs amount to ‘worse than worst-case scenario’ as investors brace for stock-market beatdown | Trump’s tariffs are expected to raise consumer prices, but a key question remains: By how much? | Wall Street stocks drop like a stone… wiping trillions off the value of 401(K)s in minutes | How do tariffs work, and who will they impact? UChicago experts explain | What Is Trump’s Rationale for Tariffs?