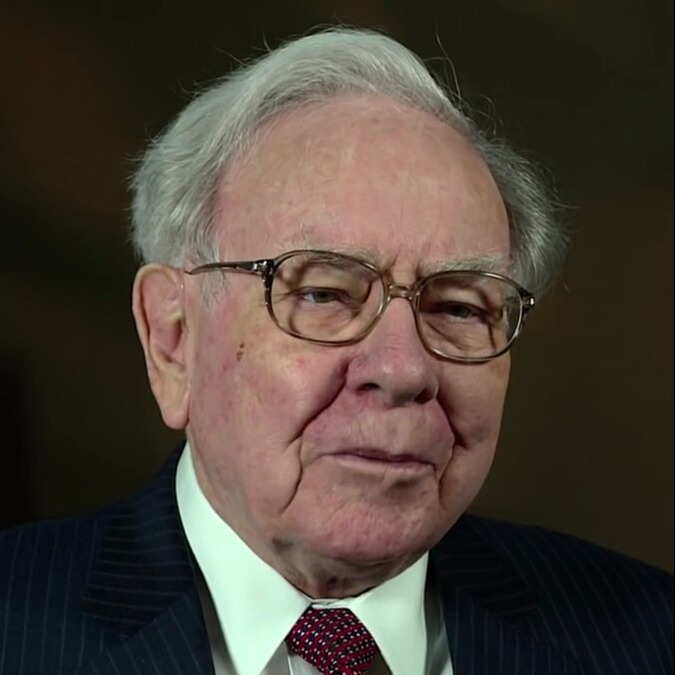

Warren Buffett at the 2015 SelectUSA Investment Summit.jpg). Photo courtesy of USA International Trade Administration. Public domain.

Warren Buffett just shocked 40,000 die-hard fans with a mic-drop retirement — and a scorching indictment of Donald Trump’s trade war. After six decades of building a business empire and making billions on the back of global capitalism, the 94-year-old billionaire used his final spotlight to call Trump’s tariffs a mistake and hand over the reins of Berkshire Hathaway to a successor nobody expected to take over — at least not this soon.

Buffett’s retirement announcement, made at the end of Berkshire Hathaway’s five-hour shareholder question and answer session in Omaha, came without warning to even his inner circle. The only board members who knew were his children, Howard and Susie Buffett. Greg Abel, now set to take the helm, had no idea until the moment Buffett said it aloud from the stage.

The Humble Billionaire

Before he became the world’s most revered investor, Warren Buffett was just a Midwestern math whiz with a knack for numbers — and a taste for fast food. For more than 50 years, he’s eaten McDonald’s® breakfast every morning, never spending more than $3.17. On richer days, he grabs bacon, egg, and cheese. When he’s feeling cheap, it’s sausage patties for $2.61. He drinks five Cokes a day and credits the diet of a six-year-old for his longevity.

He lives in the same Omaha house he bought in 1958. He works out of a modest office. He’s never owned a smartphone. And until recently, he hadn’t sent more than one email in his life.

But that humble exterior masks a financial juggernaut.

What Is Berkshire Hathaway?

Buffett turned a struggling textile company into a conglomerate powerhouse with a market cap of over $1 trillion. Berkshire Hathaway owns everything from BNSF Railway and Geico® to Dairy Queen® and a massive stake in Apple®. Its stock has delivered an average annual return of 19.9% — nearly double the S&P 500’s 10.4% — since Buffett took over in 1965.

But it’s not just performance that made Buffett’s word gospel. Markets moved when he spoke. His investment decisions shaped corporate strategies, policy debates, and public opinion.

So, when he decided to start selling instead of buying, investors paid attention.

Buffett’s Billion-Dollar Retreat

Over the past 10 quarters, Buffett has been a net seller of stocks. In 2024 alone, he dumped more than $134 billion worth of equity — primarily reducing Berkshire’s holdings in Apple and Bank of America. That fire sale ballooned Berkshire’s cash reserves to an eye-watering $347.7 billion by the end of Q1 2025.

Buffett isn’t looking to make risky moves. He’s waiting. Buffett’s warned that the market lacks attractive options and that, eventually, Berkshire will be “bombarded with opportunities” worth spending on, as reported by the Associated Press.

This isn’t just strategic. It’s defensive. And part of that defense is tied to one thing: tariffs.

Buffett’s Blistering Warning on Trade Wars

Without naming names, Buffett tore into Trump’s trade agenda. He warned that turning global trade into a weapon risks international stability and fuels animosity toward the United States.

He argued that when 7.5 billion people resent you — and 300 million boast about winning — it creates global instability, not strength.

“I don’t think it’s right, and I don’t think it’s wise,” Buffett said. “There is no question that trade can be an act of war, and I think it’s led to bad things, just the attitudes it’s brought out,” according to The Daily Beast.

Trump’s 145% tariffs on Chinese imports, announced in early 2025, triggered retaliatory levies of 125% from Beijing and sent shockwaves through global markets. While the White House later paused many of the increases — except for China — the volatility had already been unleashed. Buffett made clear that such protectionist moves, in his view, hurt more than they help.

He described the policies as a step toward economic warfare and said the United States would benefit from a world in which more countries are prosperous, not less.

Why Now?

Buffett always said he’d never step down unless he felt he was slipping. At 94, some close observers believe that moment arrived this year. At the annual meeting, Buffett made a math error during an answer and lost his train of thought during a story — subtle signs for someone known for razor-sharp recall and clarity, according to the AP.

Still, nobody expected him to hand over the reins that day.

Greg Abel — Vice Chairman and longtime heir apparent — has already been managing all non-insurance operations at Berkshire. Now, he’ll take full control. Buffett said he plans to remain as chairman through 2026 but confirmed Abel will make all final decisions starting next year.

Buffett has no plans to sell his shares, reaffirming confidence in the company under Abel’s leadership.

What’s Next for Greg Abel?

Abel is no showman, but insiders say he’s got the chops. He’s tough, sharp, and demanding. Berkshire managers say they prepare harder for meetings with Abel than they ever did for Buffett. He’s known for asking direct, analytical questions and pushing for clarity.

What he doesn’t have is Buffett’s star power — or voting control of 30% of the stock. That means less margin for error and more pressure to prove himself quickly.

But Buffett’s endorsement — and the $347 billion war chest Abel now controls — gives him a running start.

End of an Era

Buffett’s retirement marks the exit of one of capitalism’s most iconic figures, but it also highlights a shift in the global economic conversation. As he steps aside, he leaves behind more than just a $780 billion empire and a $347 billion cash reserve — he leaves a message: prosperity should be shared, not weaponized. Whether his successor Greg Abel can fill those legendary shoes remains to be seen. But one thing is clear: Buffett’s final act wasn’t just about business. It was about values. And he’s made it known — loud and clear — what kind of world he believes is worth investing in.

References: Warren Buffett shocks shareholders by announcing his intention to retire at the end of the year | Warren Buffett knocks tariffs and protectionism: ‘Trade should not be a weapon’ | Buffett defends trade amid tariff pressures, as Berkshire cash sets record | Warren Buffett’s funniest and most frugal quirks | Market capitalization of Berkshire Hathaway (BRK-B)